Over the past week, three big names in the world of esports betting have cut back on their operations: Luckbox, Unikrn and Midnite.

But why is this happening, and why now? Dom Sacco takes a look at the changes made by each company and asks betting expert Ollie Ring for his insight.

First of all, it would be rather disingenuous for us to imply that every esports viewer doesn’t want to place bets. That’s simply not true, but in general, it appears the market for esports betting hasn’t developed or grown the way some might have expected it to.

Secondly, the answer to our headline may appear to be obvious. We are in the midst of a cost of living crisis, with many focusing on their bills and essentials over leisure and entertainment, such as betting.

We’ll explore the state of esports betting in more detail further on, but with those initial caveats out of the way, for now, let’s look at what’s happened over the past week.

Midnite makes layoffs, moves focus away from esports

Midnite had all the tools to help it become a key player in esports betting, particularly in the UK.

In early 2020, Midnite announced it had secured funding and a betting license from the UK Gambling Commission, setting it apart from several other unlicensed betting providers already out there.

Midnite brought on board the UK’s first pro gamer, Sujoy Roy, as marketing director, an endemic, experienced and knowledgeable person in the industry.

Midnite also sponsored the likes of the London Royal Ravens, as well as well-known journalist and personality Richard Lewis, and Brazilian esports organisation Loud.

The company secured £12m in additional funding in early 2022, and last year, Midnite went on a hiring spree, with more than 30 people joining.

Now, however, Midnite has made job cuts, Esports News UK understands, as it focuses on sports betting and casino over esports.

While the layoffs are new, Midnite’s decision to pivot away from esports is not. We understand this was made last year.

Despite this, we understand that Midnite is not struggling nor is it in trouble. Its decision to move away from esports betting is purely a business decision, it seems. It wants to be leaner, and the board wants to focus on football more than esports.

That’s not to say it’s moving away from esports entirely. From what we understand, esports will remain one of the types of betting Midnite offers.

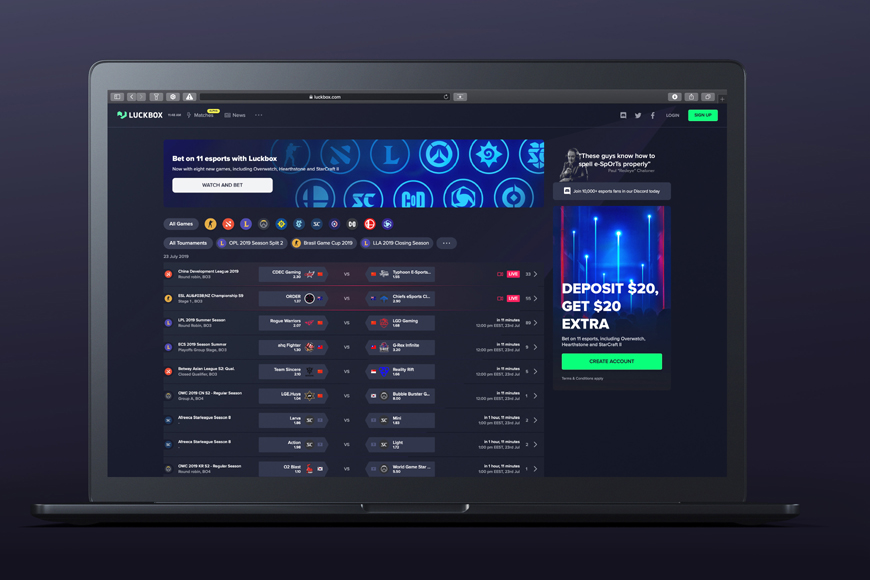

Luckbox suspends B2C esports betting

Luckbox announced a restructure of its operations on October 5th 2023.

The company, owned by Real Luck Group, said in an update on its website: “Despite the significant growth the company has experienced since the start of 2023 and its well documented and defined requirement for additional funding to support this continued expansion, it has been unable to secure the required capital injection due to persistently challenging conditions in the capital markets.

“This means an immediate suspension of betting and player registrations on its B2C (business to consumer) platform, Luckbox.com, and a shift towards the more cost effective B2B (business to business) activities of the company. B2C has generated all the company’s revenue to date, but achieving profitability will require significantly more capital than launching the B2B platform.

“The restructuring is expected to be completed this year and will result in a new optimised and better focused corporate structure with no debt and minimal cash burn.”

In 2018 Luckbox brought on board veteran esports host Paul ‘Redeye’ Chaloner as an advisor, as it prepared to launch.

While Luckbox went on to secure an Isle of Man gambling license and serve esports fans in more than 80 territories worldwide, for games like CS, Dota 2 and League of Legends, it’s ultimately this month decided to suspend B2C betting operations.

Luckbox’s website currently states: “We’re closed. This website is no longer accepting new transactions. If you have funds in your account, please log in and initiate a withdrawal. The deadline for doing so is November 5th 2023.”

Unikrn scales back on esports

Last but not least in the trio of esports betting cut backs, is Unikrn.

Older than the other two, having first launched in 2014 and later acquired by Entain in 2021 for some £50m investment, it then paused operations as it restructured.

Entain is a huge brand, operating the likes of Ladbrokes & Coral, Bwin, PartyPoker, Foxy Bingo and more, and it acquired esports betting company Sportsflare earlier this year.

Unikrn relaunched in Canada and Brazil late last year, but is now following Luckbox’s lead by scaling back on its business to consumer operations.

An Entain spokesperson said, as covered on Esports Insider: “We can confirm that we are repositioning our esports offering and scaling back our direct-to-consumer operations with unikrn.

“This is to ensure that our business is structured as effectively as possible, and so that we can best deliver on our strategy and growth plans. unikrn has developed an industry-leading offer around esports betting and we see significant opportunities to leverage these capabilities through our existing global brands.”

‘Most operators aren’t seeing the big picture’ – esports cut-backs show uncertainty around esports betting

So, why all the cut-backs?

From the various sources we’ve spoken to, there doesn’t appear to be one simple reason.

It’s clear that betting might not be for all casual esports fans, with some not willing to spend money, or even go through verification and ID processes to bet.

It shows that esports betting is a tough nut to crack. This is unsurprising given the intricacies and behaviours of the esports community and perhaps part of the nature of an ever-shifting esports industry.

One source told Esports News UK that most operators ‘aren’t seeing the big picture’ with esports wagering – that esports fans can be cross-sold into traditional sports and casino.

But, ultimately, esports betting is a smaller category compared to traditional sports, and operators ‘need to be very measured and sustainable with the spend’, one source said, urging operators to be careful when signing partnerships and marketing activities, to seek a real return on investment.

So it’s perhaps no surprise that operators are looking to the multi-billion dollar sports betting and other markets.

This is all separate to skin gambling, of course, which does appear to be relatively popular in certain games, but is not regulated, with third party and black market trading generally condemned by game publishers.

‘We need to take heed of errors’ – Ollie Ring

Ollie Ring, Head of US Regulatory Gambling Content at Finixio, editor of the Esprouts substack newsletter and former Esports Insider editor, told Esports News UK: “Esports betting isn’t going through a tough time necessarily, but people need to take heed of the erroneous errors made by these companies – and use esports as a key strategic pillar, rather than spaffing money up the wall.”

Ollie spoke of Entain’s acquisition of Unikrn, and how Unikrn was acquired, and how he believes ‘both companies were badly run, and that it doesn’t look good on the overall ecosystem’.

“Unikrn somehow got a £50m buyout, took their entire product off the market, then reolaunched it with a Brazil focus,” Ollie said. “They hired people in the US with no gambling experience, got absolutely annihilated by Rivalry because they resonate with the esports community, spent a fortune on being sponsor of the Major, but the Portuguese speaking stream was carved out of the sponsorship (Gaules) so they were advertising betting to an English audience, while the Portuguese guy was streaming to 300,000 with a GG.bet sponsorship.

“And Luckbox spent money on [bringing in] Redeye as an ambassador without even being able to market or operate in the UK.”

It’s not all doom and gloom – there are many esports betting providers out there and this article focuses on three in particular.

Many traditional bookies, like Ladbrokes, Paddy Power and Bet365, offer esports betting, and there are endemic brands like GG.bet and Rivalry, as Ollie mentioned. There are also crypto betting platforms like EsportsBet.io.

Perhaps we will see esports betting go in a different direction in the future, but the changes over the past week don’t exactly inspire confidence.

If you want more intel on the esports betting market, check out Ollie Ring’s substack in the link at the top of this article’s final section, and Cody Luongo’s substack here.

Dom is an award-winning writer and finalist of the Esports Journalist of the Year 2023 award. He graduated from Bournemouth University with a 2:1 degree in Multi-Media Journalism in 2007.

As a long-time gamer having first picked up the NES controller in the late ’80s, he has written for a range of publications including GamesTM, Nintendo Official Magazine, industry publication MCV and others. He worked as head of content for the British Esports Federation up until February 2021, when he stepped back to work full-time on Esports News UK and offer esports consultancy and freelance services. Note: Dom still produces the British Esports newsletter on a freelance basis, so our coverage of British Esports is always kept simple – usually just covering the occasional press release – because of this conflict of interest.