Update: Ukie has updated the figure to £66.2m following an update from Twitch.

Original article:

Consumers in the UK are spending slightly less money on streaming donations and video content, and more on magazines, according to a new industry report.

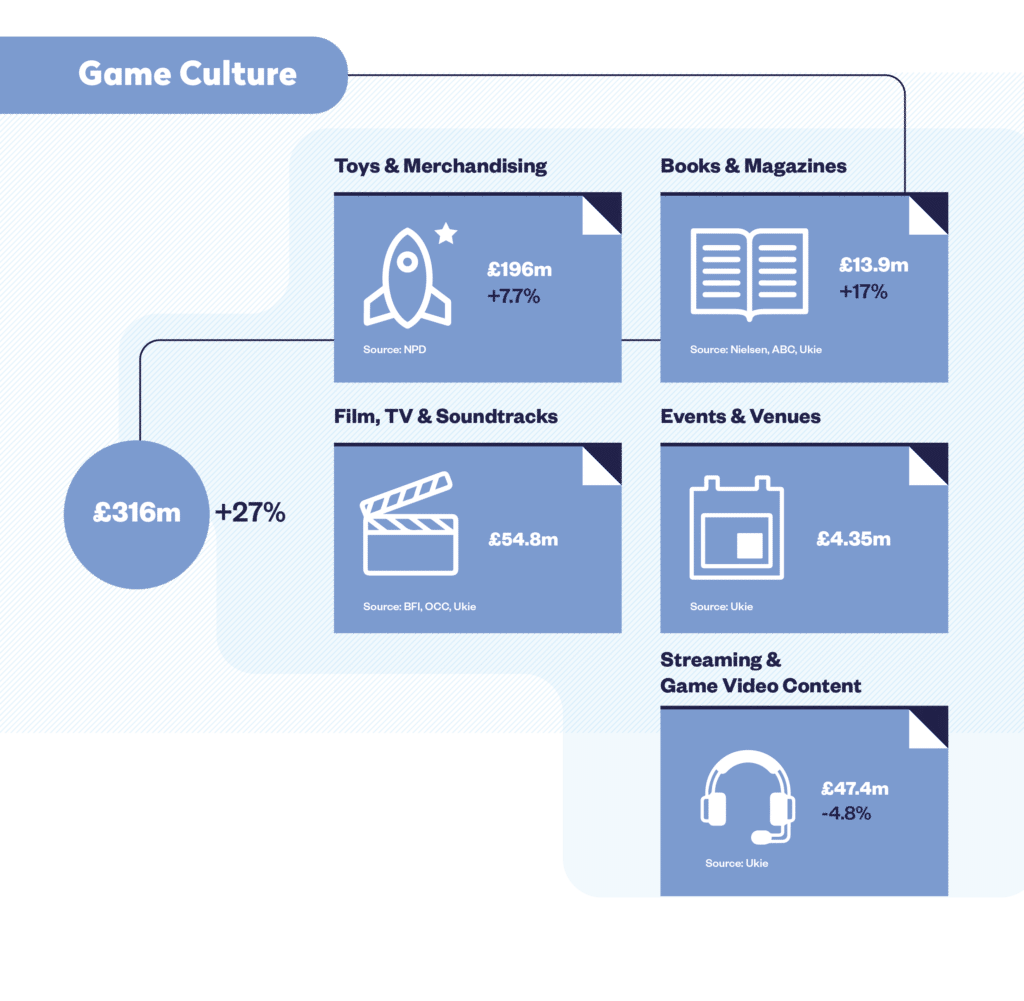

The latest UK Consumer Games Market Valuation 2022 report from UK games industry trade body Ukie found that UK viewers spent £47.4m on streaming and game video content in 2022, a drop of 4.8% year-on-year.

Ukie said this was ‘an anticipated decline following the pandemic boom period as overall industry figures level out post-pandemic’.

Surprisingly, revenues from physical gaming books and magazines were up 17% year-on-year to £13.9m.

Although this figure is still less than the amount spent on streaming, the books spend is rising, and the streaming amount is decreasing.

Back in 2020, UK consumers spent a record £45.6m on streaming donations, subscriptions and other gaming video content as viewers turned to Twitch and other platforms during the first wave of lockdowns.

Spend on streaming donations dip as events & magazine revenues rise – UK video game market valued at £7.05bn

Streaming donations and video content were just one aspect of Ukie’s 2022 Consumer Market Valuation, which found that the UK video game consumer market value in 2022 was £7.05bn overall.

Although this is a 5.6% dip on 2021’s figure, it’s still 17% above pre pandemic levels.

As mentioned, revenues from physical gaming books and magazines were up 17% year-on-year to £13.9m.

And sales of video game toys and merchandising rose 7.7%, bucking the trend of a 3% fall in the wider toy market, with Pokémon merchandise being the top performer.

Event revenues also recovered significantly in 2022, more than tripling the figure for 2021 when events were still being heavily impacted by the pandemic. Ukie says this recovery was driven by the return of established UK events such as Insomnia Gaming Festival and one-off international events like the Pokémon World Championships in London.

In 2022 event revenues hit £4.35m, which is still 56% lower than the inflation-adjusted pre-pandemic figure of £9.93m for 2019, so there is still room to grow as confidence returns both among attendees and exhibitors.

The report also found that big screen video game adaptations Uncharted and Sonic The Hedgehog 2 contributed to a significant year-on-year increase for television and soundtracks to £54.8m.

This was the biggest year for films based on video games IP at the UK box office ever, up 66% from 2019’s figure of £33 million, adjusted for inflation.

Data from video streaming platforms for video game-related programming like Paramount’s Halo series is not factored into the 2022 valuation, however this is being explored for next year’s report.

Then, looking at sales of actual video games, sales of all forms of video game hardware in 2022 were down 19% to £832m year-on-year, with console revenue down 27%, PC game hardware 14% and VR hardware by 6.6% year-on-year.

Software revenues remained steady, growing 0.4% to £4.57bn, thanks in part to growth in digital PC and mobile games sales. Mobile software was up 11% year-on-year to £1.43bn.

Digital console revenues were down by 4.7%, while boxed game sales declined 4.3%, making 2022 the only year in the past decade where boxed software has seen better year-on-year performance than digital console sales.

Looking longer term, software sales have seen solid growth compared to 2019, up 6.6% against 2019’s inflation-adjusted figure, while hardware sales exceeded 2019’s figures by 38%. This was expected, as 2019 marked the final full year of the previous generation of consoles, with the PlayStation 5 and Xbox Series X|S launching in 2020.

Best of Britain: The most popular games of 2022

According to the ERA Yearbook 2023, top performing titles in the UK in 2022 include Lego Star Wars: The Skywalker Saga developed by Cheshire-based TT Games, high-profile PlayStation exclusives God of War Ragnarök and Horizon Forbidden West, Pokémon Legends: Arceus on Switch and the critically acclaimed Elden Ring.

For the first time the valuation report covered the UK market share of UK-made games based on research from Ukie and data provided by GfK Entertainment. In 2022, 16% of the £4.57bn game software total was spent on games developed by British game companies.

What the analysts said: ‘Several factors play a part in dampening consumer confidence’

Dorian Bloch, Senior Client Director at GfK, said: “Console Hardware remained the biggest sector in game hardware but saw the steepest decline in 2022 due in part to the natural progression and uptake of ninth generation consoles which is set against the decline of the previous generation.

“Other factors included well-documented supply chain component issues, higher cost of raw materials due to shortages and shipping slow-down at warehouses and ports, which affected all hardware sectors including video games.

“Much can still be attributed to covid uncertainty, but the Russia-Ukraine war, recession, inflation, rising energy/food/living costs all play a part in dampening consumer confidence, with consumers putting off major purchase decisions – including of course game hardware.”

Year-on-year data for the 2022 report was calculated using the revised figure of £7.47bn for 2021.

The UK consumer market valuation was compiled by Ukie with the support of ABC, BFI, GfK Entertainment, Nielsen, NPD, the Official Charts Company and Omdia.

Related article: Esports contributed £111.5m to UK GDP in 2019

Top Gambling & Casino Guides

Explore some of our most popular casino, betting, and gaming guides, trusted by UK players this year.

- Best Online Casinos in the UK

- Bitcoin Casinos to Play at in July 2025

- UK Sports Betting Sites

- Top No KYC Casinos UK 2025

- Best Non Gamstop Casinos

Dom is an award-winning writer and finalist of the Esports Journalist of the Year 2023 award. He has almost two decades of experience in journalism, and left Esports News UK in June 2025.

As a long-time gamer having first picked up the NES controller in the late ’80s, he has written for a range of publications including GamesTM, Nintendo Official Magazine, industry publication MCV and others. He also previously worked as head of content for the British Esports Federation.