Consumers spent a record amount in the UK video games market in 2020, according to Ukie’s new 2020 Consumer Market Valuation report.

For the first time, the 2020 valuation included a measurement of streaming and game video content revenues, with UK consumers spending £45.6m through donations and subscriptions on platforms like Twitch, making up for a notable decline in physical event revenues.

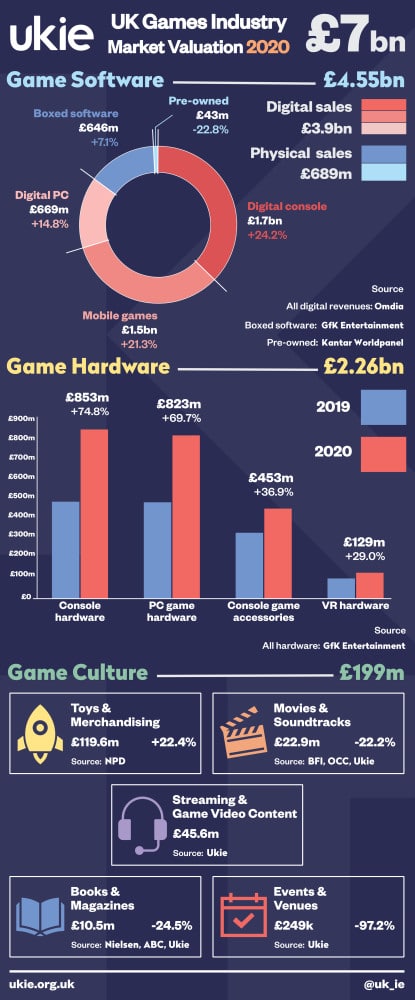

Overall, the UK consumer games market was worth £7bn in 2020 – a 29.9% increase on 2019’s market and over £1bn higher than 2018’s previous record total of £5.7bn.

These figures do not include traditional esports revenues such as sponsorships. This report mainly looks at game and hardware sales to give a picture on the overall state of the UK video games sector.

Looking at today’s general UK industry report, sales of games software across all categories grew by 18.5% from £3.8bn to £4.5bn, with revenues from digital sales encompassing 85% of all software sales. Despite limited access to the high street, sales of new boxed games reversed the trend of recent years to grow 7.1% thanks to increased use of mail order services.

“The latest consumer market valuation confirms just how valuable games proved to people across the country during one of the toughest years of our lives.”

Dr Jo Twist OBE, Ukie

Games hardware saw a record year, growing 60.8% year on year to reach £2.3bn in 2020, with homebound consumers kitting themselves up with new consoles, accessories and upgrading PC game components.

The game culture section of the valuation, measuring revenue from cultural activities associated with games also grew in 2020 to £199m, driven by a 22.4% increase in toys and merchandising revenue which countered COVID-related shortfalls in other categories.

The games market overall grew significantly as a result of the pandemic, which saw people turn to games for entertainment through lockdowns and as a way to connect with friends or family, and the arrival of a new console generation.

The valuation, published as the London Games Festival opens, also showed PC games hardware growth was driven in large parts by the shift to home working, with consumers buying dedicated games computers to ensure home working set ups could double as entertainment systems.

VR hardware sales grew by nearly a third to £129m, with the arrival of accessible, standalone headsets such as the Oculus Quest 2 driving the market forward.

“The latest consumer market valuation confirms just how valuable games proved to people across the country during one of the toughest years of our lives,” said Dr Jo Twist OBE, CEO of Ukie.

“The games sector is a growing, resilient and critical part of the UK’s successful creative industries sector. We all know how important entertainment, technology and creativity have been over the last year. The London Games Festival over the next 10 days will showcase and connect the fantastic leading games businesses right here in the UK with global audiences, investors and publishers, and will demonstrate games’ power to connect, entertain and innovate.”

The valuation was announced at the start of this year’s London Games Festival, run in partnership with Film London and Ukie. It runs from March 19th to 28th entirely online, with a wide programme of online cultural and business events and broadcasts that are free to view and includes the Festival’s first ever Official Selection of 40 games to discover and play.

The UK consumer market valuation was compiled by Ukie with the support of ABC, BFI, GfK Entertainment, Kantar Worldpanel, Nielsen Bookscan, NPD, the Official Charts Company and Omdia.

Dom is an award-winning writer and finalist of the Esports Journalist of the Year 2023 award. He has almost two decades of experience in journalism, and left Esports News UK in June 2025.

As a long-time gamer having first picked up the NES controller in the late ’80s, he has written for a range of publications including GamesTM, Nintendo Official Magazine, industry publication MCV and others. He also previously worked as head of content for the British Esports Federation.