What Does KYC Mean in Online Gambling?

Elliot Law, Senior Editor

Last Updated: 12/02/2026

Darragh Harbinson, Senior Editor

Fact-checker

If you’ve ever signed up for a financial service or online casino in the UK, chances are you’ve encountered the term “KYC” – but what does KYC mean, and why is it so important? In this article, you’ll find a clear, concise explanation of Know Your Customer (KYC) processes, including KYC verification, and the customer identification programme, why they’re required, and how they protect both businesses and consumers. We’ll show you how KYC ensures security, prevents fraud, and aligns with UK regulations such as those set by the Gambling Commission. Whether you’re a seasoned player or new to online platforms, understanding KYC can help you play and trade with confidence.

- Show full guideShow less

What is KYC?

KYC, short for Know Your Customer, is a standard process used by many types of businesses, including the best betting sites in Great Britain, to verify the identity of their clients. It involves basic due diligence, gathering and validating personal details to confirm that a customer is who they claim to be. This process plays a vital role in preventing illegal activities such as fraud, money laundering, and the financing of terrorism.

The primary purpose of KYC is to protect financial institutions and their customers by enhancing transparency and fostering trust. By understanding their clients and evaluating risks, companies can address potential problems and fulfill legal requirements. KYC also strengthens trust in financial systems, making it harder for criminals to exploit vulnerabilities and supporting initiatives like the Financial Crimes Enforcement Network.

Key Objectives of KYC

- ✅ Identity Verification: Confirm the individual opening or managing an account is legitimate and not using stolen or fake credentials.

- ✅ Risk Evaluation: Assess the customer’s financial activity, source of income, and determine if they pose a high risk for unlawful activities.

- ✅ Fraud Prevention: Detect and stop fraudulent transactions, ensuring the institution isn’t used as a channel for criminal enterprises.

UK Legal and Regulatory Framework for KYC

KYC procedures are legally required in the UK, laid out under anti-money laundering regulations and policies, ensuring financial institutions do their due diligence. These laws ensure financial institutions and operators who want to be known as safe casino sites do their due diligence to prevent money laundering, fraud, and the funding of illegal activities. Key regulatory authorities and frameworks in the UK include:

- The Financial Conduct Authority (FCA): Governing body for financial institutions in the UK.

- The Money Laundering Regulations 2017: Core legislation underpinning AML and KYC in the UK.

- HM Treasury: Sets legal frameworks and ensures compliance with international AML standards.

- Financial Action Task Force (FATF): Global body setting AML and KYC benchmarks.

Failure to comply with KYC and AML laws in the UK can lead to severe penalties, including hefty fines and reputational damage. In extreme cases of failing KYC compliance, it can even result in legal action that may disrupt business operations.

By adhering to KYC requirements, UK businesses not only protect themselves from financial crime but also reinforce trust and integrity, enhancing customer relationships within the financial system.

Key Stages of the KYC Process in the UK

The Know Your Customer (KYC) process is a critical framework used by financial institutions in the UK to gather, verify, and monitor customer information. It ensures legal compliance, through thorough document verification reduces financial crime, and helps prevent fraud. The process typically involves four main stages, each vital for identifying and managing customer risk effectively.

1. Customer Identification Process (CIP)

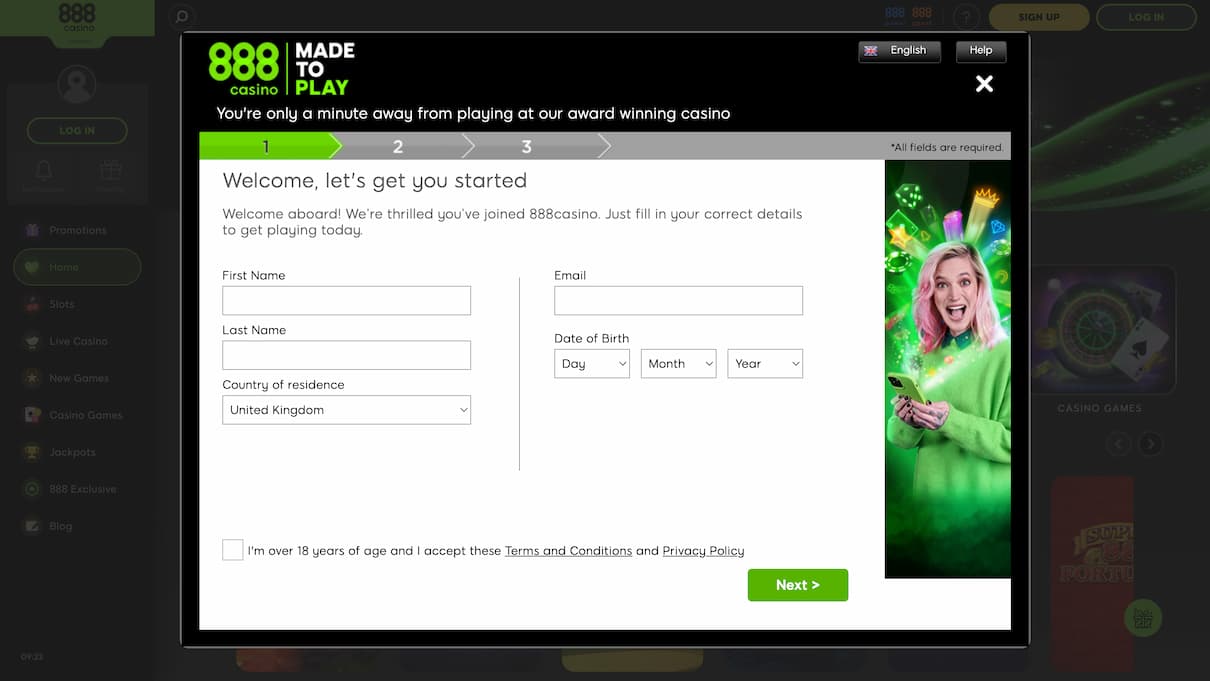

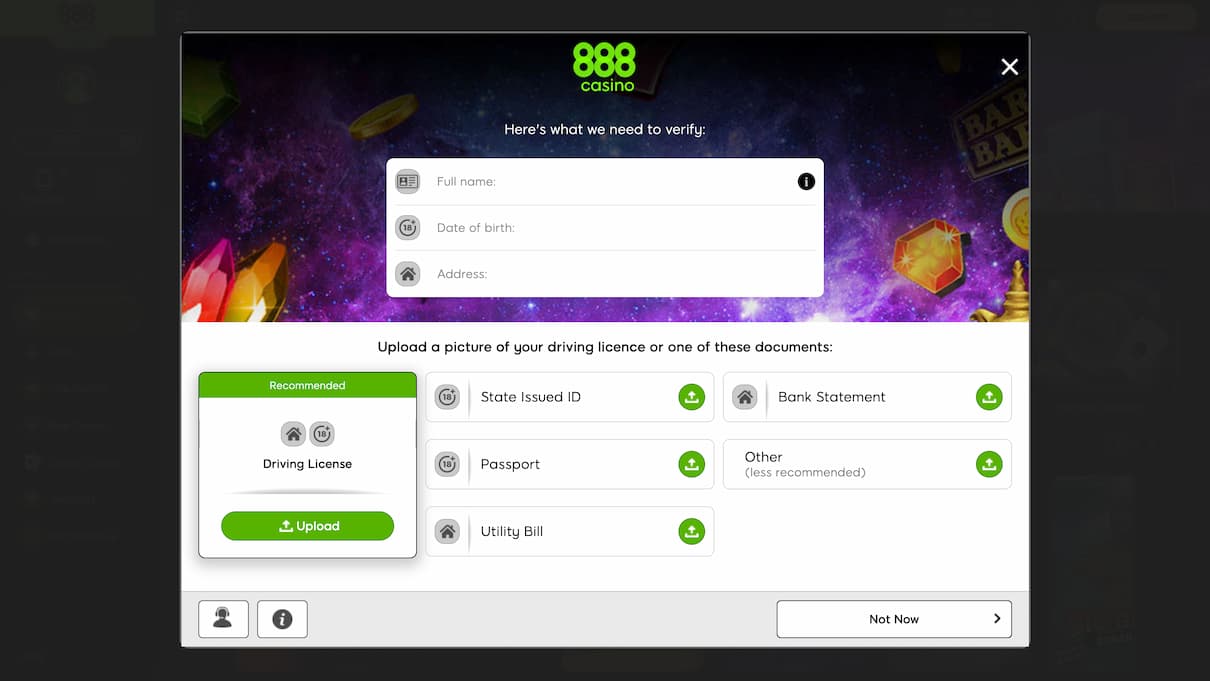

The first stage of the KYC process is implementing a Customer Identification Process (CIP). This involves collecting and verifying basic personal information from customers, including:

- 👉 Full name

- 👉 Date of birth

- 👉 Residential address

- 👉 Government-issued identification, such as a passport, driving licence, or UK national ID

The goal of CIP is to confirm the customer’s identity before establishing a financial relationship. In the UK, this step is a legal requirement under Anti-Money Laundering (AML) regulations, ensuring businesses safeguard against financial crime.

2. Customer Due Diligence (CDD)

After confirming a customer’s identity, financial institutions carry out Customer Due Diligence (CDD). This step involves assessing the customer’s profile to determine their risk level. Key factors analysed include:

- Purpose and nature of the relationship

- Source of funds or income

- Type and frequency of expected transactions

- Geographical areas involved in transactions

CDD helps financial organisations identify potential irregularities and spot risks early through transaction monitoring, protecting them from fraud, money laundering, or other illicit activities.

3. Enhanced Due Diligence (EDD)

For higher-risk customers or complex transactions, financial institutions undertake Enhanced Due Diligence (EDD). This involves a more in-depth investigation into the customer’s background, financial activities, and associations. EDD is commonly applied to assess the risks involved :

- Politically exposed persons (PEPs)

- Individuals or businesses from high-risk countries

- Customers involved in unusually large or unexplained transactions

EDD may require additional documentation, interviews, or the use of third-party verification to gain a complete understanding of the customer’s risk profile. It ensures that with reasonable diligence, these customers are thoroughly vetted before entering into a financial agreement.

4. Continuous Monitoring

KYC in the UK goes beyond on-boarding new customers and focuses on continuous customer identification to ensure compliance. Continuous monitoring is essential to ensure ongoing compliance with UK regulations and to identify any suspicious activity. This involves:

- Regularly updating customer information

- Monitoring transactions for unusual or high-risk behaviour

- Reassessing customer risk levels periodically

- Reporting suspicious activities through Suspicious Activity Reports (SARs), as required by UK regulations

Continuous monitoring allows organisations to stay proactive, respond swiftly to potential threats, and remain compliant with evolving legal requirements.

By following these key stages, UK financial institutions ensure they meet regulatory standards while protecting themselves and their customers from financial crime.

Why is KYC Vital in the UK?

KYC (Know Your Customer) is a cornerstone of maintaining the security, credibility, and transparency of the UK’s financial systems. Far from being just a tick-box exercise, it plays a crucial role in risk management, safeguarding consumers, and ensuring compliance with British regulations.

1. 🟢 Protects Against Identity Fraud

KYC verifies a customer’s identity using official documents like passports, driving licences, and utility bills, as well as identifying beneficial owners. This process helps to prevent identity fraud and impersonation, ensuring that accounts are opened by legitimate individuals. UK financial institutions use these measures to shield both themselves and their customers from scams and other fraudulent activities.

2. 🟢 Tackles Money Laundering and Terror Financing

A key objective of KYC in the UK is to combat money laundering and prevent the financing of terrorism. By analysing a customer’s financial behaviour and financial transactions alongside transaction patterns, banks and institutions can flag suspicious activity and report it to regulatory bodies like the Financial Conduct Authority (FCA). or through Suspicious Activity Reports (SARs), playing a vital role in protecting national security.

3. 🟢 Helps Manage Risk Effectively

KYC allows institutions to assess the risk levels of their customers. High-risk individuals, such as Politically Exposed Persons (PEPs) or those with connections to high-risk countries, are identified and monitored more closely through Enhanced Due Diligence (EDD). This proactive approach ensures businesses can mitigate risks before they escalate, complying with KYC obligations.

4. 🟢 Ensures Compliance with UK Regulations

In the UK, strict anti-money laundering (AML) and counter-terrorism financing (CTF) laws, such as the Money Laundering Regulations 2017, require financial institutions to have rigorous KYC processes in place, including proper handling of KYC documents. Failing to comply can result in:

- 🚩 Severe monetary penalties

- 🚩 Legal actions

- 🚩 Suspension of licences

- 🚩 Damage to reputation

By adhering to these regulations, UK institutions can avoid hefty fines and continue operating within the law.

5. 🟢 Builds Confidence and Trust

Strong KYC practices not only comply with legal requirements but also show customers that an institution prioritises their safety. This commitment to security fosters trust and enhances the credibility of banks and businesses, which is essential for long-term client relationships and sustainable growth.

In the UK’s ever-evolving financial landscape, robust KYC processes are more than a necessity – they’re a foundation for trust, security, and compliance.

How Does KYC Work in the UK?

In the UK, Know Your Customer (KYC) processes are essential for verifying a person’s or organisation’s identity and ensuring compliance with financial regulations. These processes typically involve several steps, starting with collecting important documents such as government-issued ID, proof of address, and utilising digital identity verification for a thorough assessment of financial dealings.

Financial institutions may also perform background checks by referencing databases to cross-check information and identify any potential risks, such as links to criminal activities or sanctions lists. Once this data is collected, it is reviewed to determine the customer’s risk profile. Customers flagged as high-risk may undergo Enhanced Due Diligence (EDD), which includes more detailed checks and ongoing monitoring to ensure compliance over time.

Many institutions, as well as the UK’s top online casinos, leverage advanced technologies like artificial intelligence and machine learning to simplify and speed up KYC checks. These tools can detect irregularities, automate ID verification, and enhance efficiency by referencing the federal register, ensuring a seamless experience for genuine customers while maintaining strict adherence to regulatory standards.

Challenges and Criticisms of KYC in the UK

Know Your Customer (KYC) protocols are vital for ensuring security and regulatory compliance. However, they pose several challenges that impact consumers, businesses, and regulators across the UK.

1. 🔴 Privacy Concerns and Data Protection

KYC procedures require collecting sensitive personal details, such as identity documents and occasionally bio-metric data, which raises serious privacy issues:

- Customers are concerned about how their personal data is stored, used, and shared.

- Data breaches or leaks could expose personal information to cyber-criminals, increasing the risk of scams.

- Weak data protection measures may result in identity theft or fraud.

Strong cybersecurity measures and clear data handling policies are essential, and while all UKGC gambling sites must adhere to these, only the best offshore online casinos do the same.

2. 🔴 Barriers for Vulnerable or Under-served Groups

KYC processes can unintentionally exclude vulnerable or underserved populations in the UK:

- Unlike no ID verification casinos, which often bypass traditional checks, people without a valid government-issued ID, such as refugees or those in rural areas, struggle to meet KYC requirements.

- Elderly individuals or those less comfortable with technology may face difficulties with digital verification systems.

- People on low incomes may lack access to the necessary technologies or documentation.

These barriers can exacerbate financial exclusion, restricting access to banking services, credit, and other essential resources.

3. 🔴 High Costs for Businesses

Implementing KYC systems can be expensive for UK businesses:

- Costs include investment in technology, staff training, verification services, and ongoing compliance monitoring.

- Small businesses and start-ups often find these expenses overwhelming.

- Additional operational costs arise from false positives and manual reviews.

These expenses are frequently passed on to customers, leading to higher fees or reduced availability of services.

4. 🔴 False Positives and Delayed On-boarding

KYC systems in the UK can sometimes flag legitimate customers incorrectly as high-risk or suspicious:

- This results in unnecessary delays in opening accounts or processing transactions.

- Customers may become frustrated and take their business elsewhere.

- Excessive scrutiny on low-risk individuals wastes time and resources.

Balancing rigorous compliance with a smooth customer experience remains a significant challenge for organisations implementing KYC.

The Future of KYC in the UK

The Know Your Customer (KYC) process is undergoing a significant transformation in the UK, driven by technological advancements and evolving regulatory landscapes, all aligned with KYC requirements. These changes are shaping a more efficient, secure, and user-friendly approach to verifying customer identities. Here are the key trends influencing the future of KYC in the UK:

1. Embracing Digital KYC (eKYC)

Digital KYC, or eKYC, is revolutionising how companies onboard customers by offering a swift, paperless verification process. Using secure digital platforms, organisations can complete KYC checks far quicker than traditional methods. This reduces administrative errors, improves data accuracy, and creates a smoother experience for customers. In the UK, where financial inclusion remains a priority, eKYC is making it easier for under-served communities to access critical financial services without delay.

2. Leveraging Blockchain and Bio-metric Technology

Blockchain technology is enhancing the transparency and security of KYC processes. By using decentralised and tamper-proof data storage, businesses can securely share verified customer information across institutions while maintaining compliance and privacy. In the UK, the adoption of bio-metric authentication methods, such as fingerprint and facial recognition, adds an additional layer of security to identity verification. Together, these technologies are reducing the risks of financial fraud and identity theft while ensuring a robust customer verification process.

3. Moving Toward Standardised Regulations

One of the challenges for UK businesses operating globally is the lack of uniform KYC standards across countries. However, there is growing momentum to establish harmonised regulations that streamline compliance while addressing the complexities of cross-border transactions. In the UK, regulators are working closely with financial institutions and technology providers to develop frameworks that simplify international KYC processes, ensuring businesses can adapt to diverse regulatory environments without compromising security.

4. Focus on Balancing Security and Convenience

In the UK, where consumer protection is a top priority, KYC systems are shifting to balance robust security with user convenience. Customers expect a seamless verification experience that leverages digital identity and doesn’t compromise their privacy or safety, as account owners generally seek convenience in their financial interactions. Emerging technologies and streamlined processes are helping UK institutions meet these expectations, ensuring a compliant yet user-friendly approach to KYC.

Conclusion

KYC remains a cornerstone of the UK’s financial sector, fostering trust between institutions and their customers. By verifying customer identities, KYC helps prevent fraud, money laundering, and other financial crimes, safeguarding both individuals and the integrity of the financial ecosystem.

As UK financial institutions embrace cutting-edge technologies and adapt to evolving regulations, they must continue to prioritise both compliance and customer experience. By striking the right balance, KYC processes can support a secure, accessible, and efficient financial environment in an increasingly connected world. The future of KYC in the UK is clear: innovation and regulation will work hand in hand to create systems that protect financial institutions and their customers alike.

FAQs

What is a customer identification programme in KYC?A customer identification programme is a core element of KYC regulations used by banks, casinos, and other financial institutions to verify a client’s identity before forming a business relationship. It ensures the institution can assess risk effectively and is essential for meeting KYC obligations under the Financial Industry Regulatory Authority in the UK.How does KYC help prevent financial crime?KYC plays a crucial role in combating financial crime by identifying individuals involved in fraudulent or illegal activities. Through basic due diligence and ongoing monitoring, organisations in the investment industry and other financial institutions can detect suspicious behaviour, reduce fraud, and maintain transparency while staying aligned with compliance requirements.Why is anti-money laundering tied to KYC processes?KYC is a fundamental part of anti-money laundering efforts. It helps institutions perform due diligence and assess risk before entering into a business relationship. Meeting KYC obligations allows financial entities to monitor transactions on an ongoing basis, ensuring they are not being misused for laundering illicit funds – something especially critical in today’s increasingly global economy.What role does digital identity verification play in KYC?Digital identity verification is now a standard method for confirming customer details securely and efficiently. Many businesses use biometric verification, such as facial recognition, to streamline compliance requirements. This is particularly useful for online platforms like Coral Casino or CasiGO Casino, helping ensure user safety and adherence to KYC regulations.How does KYC affect corporate customers differently?Corporate customers often face stricter minimum KYC requirements due to the larger scale and complexity of their transactions. Financial institutions must conduct enhanced due diligence and assess risk based on corporate structure, beneficial ownership, and source of funds, all while meeting compliance requirements set by regulatory authorities.Why is digital identity crucial in the UK’s financial sector?Digital identity is essential in helping the financial sector, including online casinos, verify users quickly and accurately. In an increasingly global economy, digital tools help maintain secure customer on-boarding while fulfilling KYC regulations and protecting both individuals and businesses from fraud and non-compliance.Elliot Law, Senior Editor

Elliot has a background in journalism which he combines with his extensive gambling knowledge to bring you in-depth, honest reviews, guides, and articles. After years in the field of iGaming and online sports betting, he aims to give you the hottest tips and guide you towards the best online gambling platforms in the industry.

This article has been Fact-checked by Darragh Harbinson

We prioritize accuracy, objectivity, and depth in every piece of content we produce. Our rigorous editorial standards ensure that all information is carefully sourced and fact-checked. Each article is meticulously reviewed by experienced editors and leading technology professionals to maintain the highest level of credibility and relevance. This commitment guarantees our readers content they can trust and rely on.

From breaking news and in-depth match analysis to exclusive interviews and behind-the-scenes content, we bring you the stories that shape the esports scene.

40k+Monthly Visitors

100%User Satisfaction

10+Years experience

Popular Pages